how to get rid of a car with a lien

Remove a lien on your car. The tax lienholder would get 5000 plus costs.

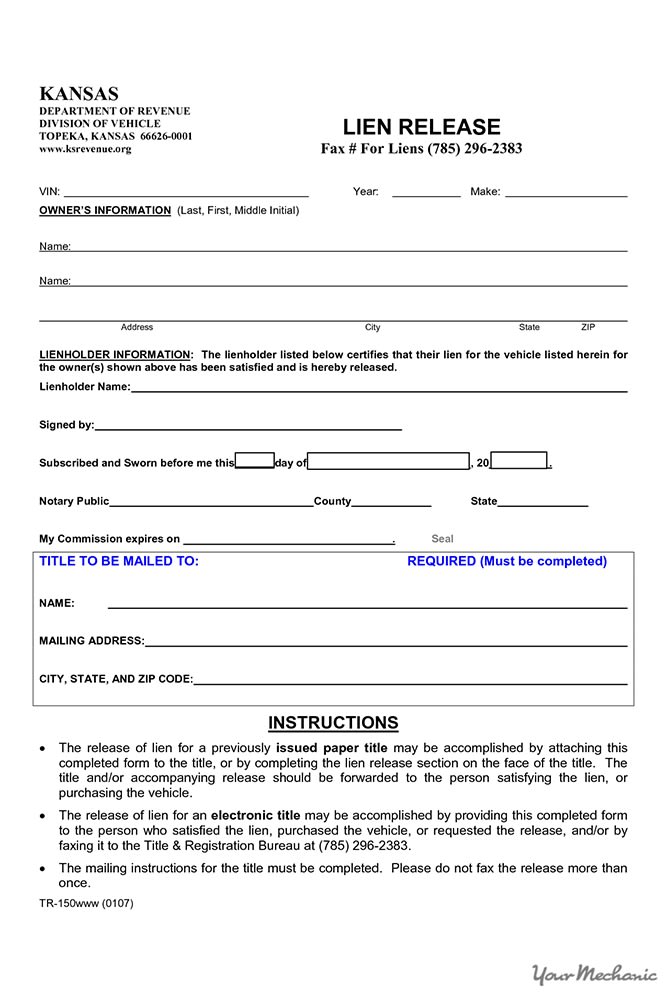

How To Buy A Car With A Lien On It Yourmechanic Advice

The IRS releases your lien within 30 days after you have paid your tax debt.

. Changing lives and helping kids graduate since 1992 Cars for Kids is a 501 c 3 Non-Profit Organization benefitting the Texans Can Academies of Dallas Fort Worth Houston Austin and San Antonio. The new car you bought 3 years ago for 30000 is worth just over 15000 today and youre thinking it might be time to trade it in before its value vanishes completely. If youre buying the car with a loan you will need to work with both your lender and the lien holder to come to an agreement.

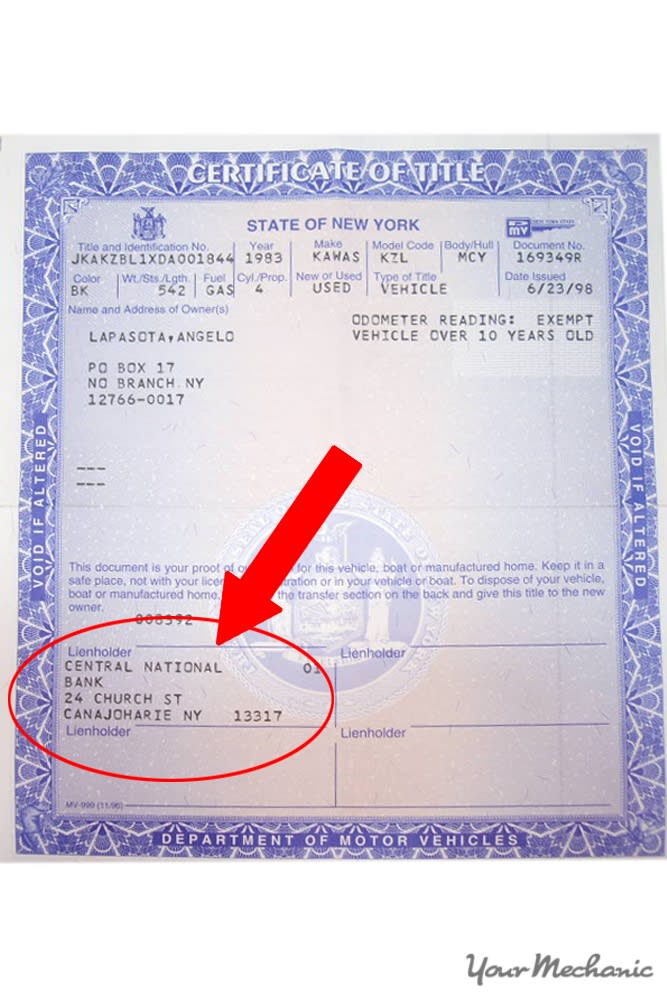

The lien gives a creditor a secured interest in your property. The homeowner would receive the balance. A lien serves to guarantee an underlying obligation such.

The first thing you need to do is get a 10-day payoff quote from your current lender. Usually the only way to get rid of the mortgage insurance premium on an FHA loan is to refinance the loan with a non-FHA lender according to Shawn Sidhu branch manager and mortgage broker with. Civil Judgments You Cant Get Rid of in Bankruptcy.

How to Get Rid of a Lien. While him and my son wait at the store to get the car. If you sell it you cant give the buyer the title without first paying off the loan amount.

Personal property liens attach to real property or personal property so that you cant sell or get rid of the property until the debt is paid off. The mortgage lien holder would get the full payoff balance of 50000. Getting rid of your mode of transportation isnt ideal but if you cant stick to your repayment schedule you may lose the vehicle anyway.

The lien against your car is based on the remaining loan balance. By selling it you can be in control of the process and you may be able to get enough cash in the sale for a down payment on a less expensive car. As public records liens tell other potential creditors that there are existing claims to the propertyNew lenders wont be first in line when it comes time to get repaid.

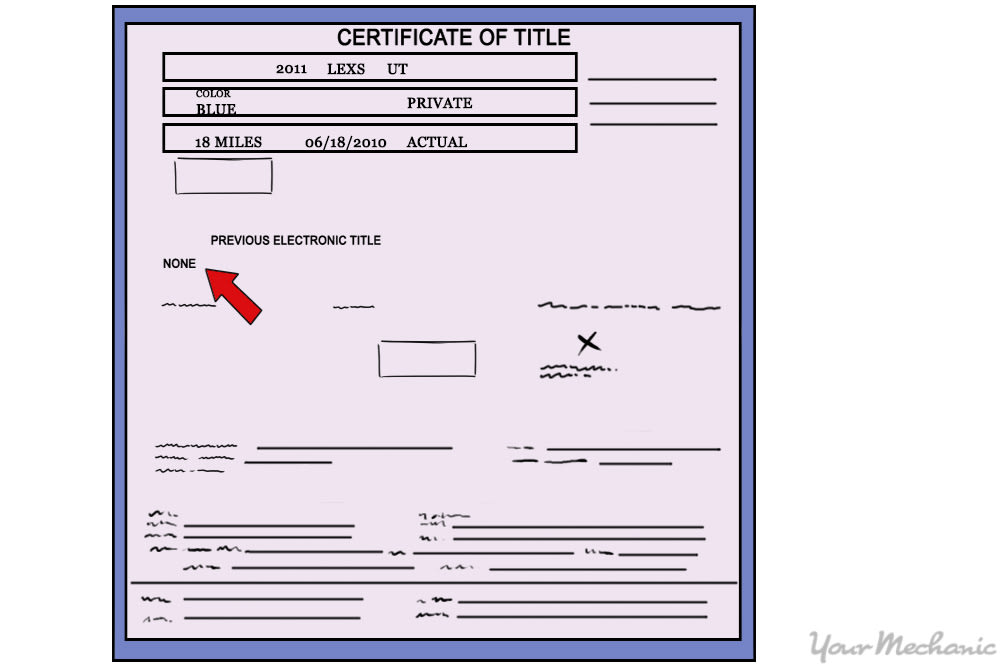

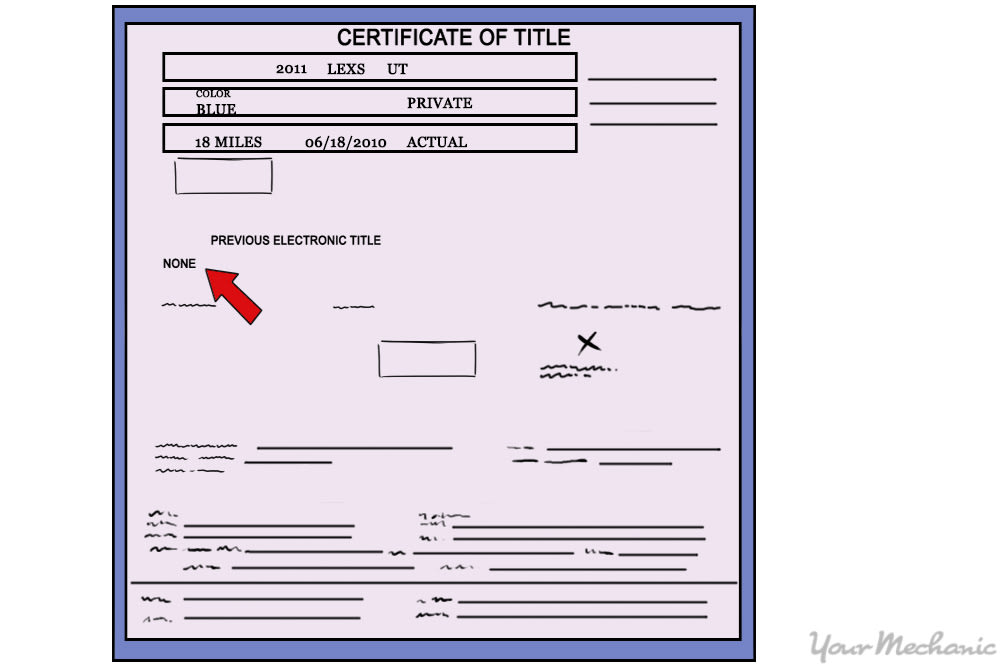

To get a free basic VIN check go to Vehicle Historys private website and enter your 17-digit VIN number in the middle of the page to get your vehicles history report. A lien is a legal right granted by the owner of property by a law or otherwise acquired by a creditor. If you sell your property the proceeds will go to the creditor to pay off the lien.

When your lender places the lien it noted on the car title and your insurance policy. When conditions are in the best interest of both the government and the taxpayer other options for reducing the impact of a lien exist. Buying a used car could offer a better deal financially than buying new thanks to depreciation.

If this is the case you may be able to pay cash to the lender rather than to the seller directly. Consider Selling the Car. Arctic Monkeys Document a Breakup in Heartbreaking Single Thered Better Be A Mirrorball Introspective tune comes from the groups forthcoming album The Car out Oct.

All vehicle and car donations help change the lives of at risk youth by providing them the highest quality high school education in an environment where they can flourish and. In order to get rid of your old vehicle and finance a new one in this situation you need to follow three steps to getting rid of negative equity. Sometimes a seller is trying to get rid of the car to pay off the debt he owes on it.

This is an added annual cost about 03 percent to 15 percent of your mortgage. The bankruptcy court wont discharge or wipe out the debt if the state or bankruptcy court finds the following. For instance suppose a creditor has a lien on your car.

Then make sure the car wasnt stolen by entering the VIN number on the NICB website which reports previous thefts or collisions. Paying your tax debt - in full - is the best way to get rid of a federal tax lien. Homebuyers with a down payment of less than 20 percent are usually required to get private mortgage insurance or PMI.

This notation is made so that any future buyer of your car is aware of the lien. So i caught the cab to go get the the van had my drivers license and car insurance and registration and the money to get it out. Liens may give creditors the legal right to take your property and sell it if you dont repay your debt.

Getting a good deal on a used car can be done by conducting thorough research online checking out. So we had to catch 3 buses to get to thiis place to get our van and my husband told to me catch a cab to get to the place to get the car. For example say theres a 5000 tax lien on the property described above.

The property is sold at a tax deed auction for 100000. While getting rid of that used vehicle might seem like the smartest move you shouldnt use the last couple of years of depreciation as an indication of what will. As a result it will be difficult or impossible to sell the property until the lien is cleared up.

Buying A Car With A Lien Bankrate

Selling A Vehicle With A Lien Is Not A Good Idea

What Is A Vehicle Lienholder How Does A Car Loan Affect A Car Title

Is There A Lien On My Car Here S What You Need To Know Rategenius

How To Get A Lien Lifted From A Used Car Bankrate Com

How To Get Your Title After Paying Off Car Loan

How To Buy Or Sell A Car With A Lien Carfax

5 Tips For How To Remove A Lien From Your Car S Title

What Is A Lien On A Car How Can I Get It Removed Credit Karma

How To Sell A Car With A Lien Coverage Com

How To Replace A Car Title Yourmechanic Advice

How To Find Out If A Car Has A Lien On It Yourmechanic Advice

How To Buy A Car With A Lien On It Yourmechanic Advice

How Can You Get A Title Loan With A Lien Cash 1 Blog News

Buying A Car With A Lien Forbes Advisor

How To Find Out If A Car Has A Lien On It Yourmechanic Advice

Buying A Car With A Lien Bankrate