the little book that beats the market reddit

His investment company Gotham Funds boasted over 40 in annual returns over a period of 20 years from 1986 to 2006. You probably wont do better than this.

The Best Investment Books For Beginners In 2021 Spy

When you want it.

. How The Market Beat The Little Book That Beats The Market. In The Little Book That Beats the Market a New York Times bestseller with over 300000 copies in print Greenblatt explains how investors can systematically apply a formula that seeks out good businesses when they are available at. Heres a summary of the book The Little Book That Beats The Market by Joel Greenblatt a hedge fund manager investor writer and professor most notably known for Magic Formula Investing - an investment strategy he outlines in this book.

Two years in MBA school wont teach you how to double the markets return. In The Little Book that Beats the Marketa New York Times bestseller with 300000 copies in printGreenblatt explained how investors can outperform the popular market averages by simply and systematically applying a formula that seeks out good businesses when they are. The Little Book That Beats the Market Joel Greenblatt John Wiley Sons Inc.

In 2005 Joel Greenblatt published a book that is already considered one of the classics of finance literature. Low Prices on Millions of Books. Ad Best prices in the world.

In 2005 Joel Greenblatt published a book that is already considered one of the classics of finance literature. Dont miss it. Support the channel by getting The Little Book that Beats the Market by Joel Greenblatt here.

Two hours with The Little Book That Beats the Market will. The 12-Step Program for Active Investors which Ill also be posting a review about shortlyAlternating between the two books was like a roller coaster the Little Book fanning. Joel Greenblatt is a legend.

In The Little Book Joel Greenblatt Founder and Managing Partner at Gotham Capital with average annualized returns of 40 for over 20 years does more than simply set out the basic principles for successful stock market investing. Yet 99 of the top comments are time in the market beats timing the market Well this is all fun and games but that is completely based on past performance of mostly the SP 500. By Joel Greenblatt In 2005 Joel Greenblatt published a book that is considered one of the classics of finance literature.

In The Little Book that Beats the Market--a New York Times bestseller with 300000 copies in print--Greenblatt explained how investors can outperform the popular market averages by simply and systematically applying a formula that. In 2005 Joel Greenblatt published a book that is already considered one of the classics of finance literature. The perfect one for you.

Ad Free 2-Day Shipping with Amazon Prime. The Little Book That Still Beats The Market Summary Animated - Get Long-Term Profits Using Math. Essentially the author says it comes down to.

Two hours with The Little Book That Beats the Market will. Two years in MBA school wont teach you how to double the markets return. Theres been a lot of buzz about The Little Book That Beats the Market so I was excited when it finally came in from the libraryOf course at the time I was midway through Index Funds.

Included are data and analysis covering the recent financial crisis and model performance through the end of 2009. The only other major group to close with gains was the financials. Same with things as buy the dip when an index drops 0001 and people pretend that everything is on a.

Dont let the negative reviews dissuade you. In a straightforward and accessible style the book explores the. The ubwbtitan community on Reddit.

A Stock-Pickers Guide To Joel Greenblatts Magic Formula Sep. In The Little Book that Beats the Marketa New York Times bestseller with 300000 copies in printGreenblatt explained how investors can outperform the popular market averages by simply and systematically applying a formula that seeks out good businesses when they are. 12949 Greenblatt ffirsfqxd 10705 850 AM Page iii.

Right off the bat Joel Greenblatt the author lets you know that most professional investors. How you want it. Two years in MBA school wont teach you how to double the markets return.

However President Obamas announcement had little impact on the rest of the market. It hiked fees in 2014 and 2018 by 20 each time. Hi new to value investing but was wondering if people had read this book and thought this was a good strategy for screening value companies.

Reddit gives you the best of the internet in one place. Now with a new Introduction and Afterword for 2010 The Little Book that Still Beats the Marketupdates and expands upon the research findings from the original book. Two hours with The Little Book That Beats the Market will.

In The Little Book That Beats the Market a New York Times bestseller with 300000 copies in printGreenblatt explained how investors can outperform the popular market averages by simply and systematically applying a formula that seeks out good businesses when they are. Annual returns from 1988 through. Page 2 of 178.

Greenblatt spends about half of this short very easy-to-read book touting the results of the 17-year back-testing of his formula. In The Little Book Joel Greenblatt Founder and Managing Partner at Gotham Capital with average annualized returns of 40 for over 20 years does more than simply set out the basic principles for successful stock market investing. He calls this the magic formula.

Thoughts about the little book that beats the market. Joel follows in Benjamin Grahams footsteps of value investing which means buying undervalued. Hes come up with a simple method that works tested it and is sharing it.

This is a sincere book written by an obvious expert who has the humility to acknowledge the well established fact that most investment advisors cant beat the market. This is the third time since the launch of Amazon Prime that the e-commerce giant raises prices for its yearly delivery service in the US. In 2005 Joel Greenblatt published a book that is already considered one of the classics of finance literature.

15 2020 617 AM ET. Httpsamznto2pUZ3zK As an Amazon Associate I earn from qual. Regional banks were up 14 and multiline.

In The Little Book Joe. Best you can get.

Little Book That Beats The Market R Valueinvesting

Beatitud Visiones De La Beat Generation Diane Di Prima Inspiring Girls Literatura Escritores Historia

Little Book That Beats The Market R Valueinvesting

Amazon Com The Little Book Of Big Dividends A Safe Formula For Guaranteed Returns Audible Audio Edition Charles B Carlson Sean Pratt Terry Savage Gildan Media Llc Books

The Little Book That Beats The Market Review Diy Investing

The Little Book Of Investing Like The Pros Five Steps For Picking Stocks By Joshua Rosenbaum

The Acquirer S Multiple By Tobias Carlisle Youtube

The Best Investment Books For Beginners In 2021 Spy

Top 18 Best Investing Books To Read For Every Investor 2022 List Crux Investor

The Little Book Of Investing Like The Pros Five Steps For Picking Stocks By Joshua Rosenbaum

The Little Book Of Investing Like The Pros Five Steps For Picking Stocks By Joshua Rosenbaum

Best Trading Books In 2022 50 Top Books For Mastering Trading Filmmaking Lifestyle

![]()

Anyone Read Joel Greenblatt S The Little Book That Still Beats The Market R Valueinvesting

Top 18 Best Investing Books To Read For Every Investor 2022 List Crux Investor

Little Book That Beats The Market R Valueinvesting

The Little Book That Beats The Market Review Diy Investing

Bears Beets Battlestar Galactica By Kasey At The Corner Tattoo In Cocoa Beach Fl Nerd Tattoo Tattoos Movie Tattoos

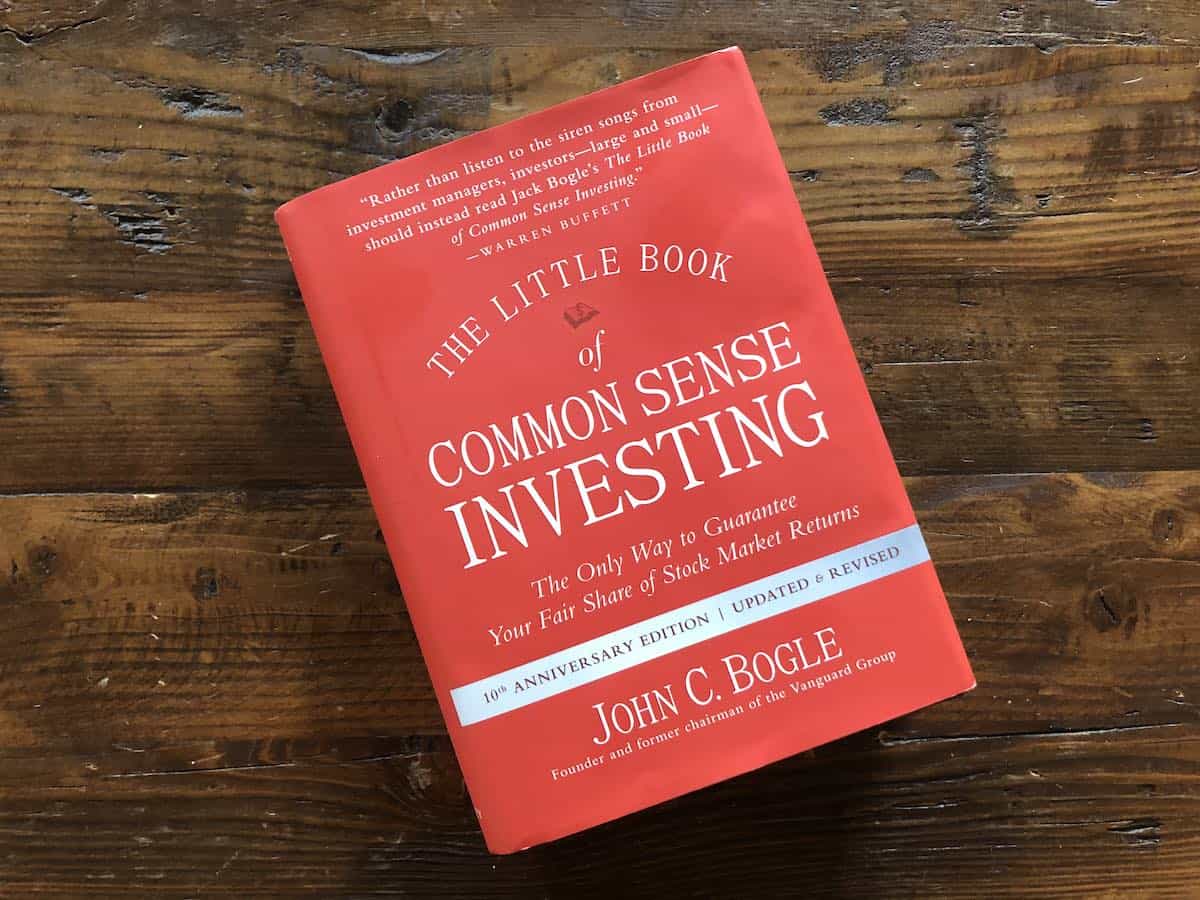

The Little Book Of Common Sense Investing By John C Jack Bogle